In this blog post, we will analyze China’s GDP growth from the year 1960 to 2019. If the data shows a curvy trend, then linear regression will not produce very accurate results when compared to a non-linear regression.

# import libraries

import numpy as np

import pandas as pd

import matplotlib.pyplot as plt

%matplotlib inline# read the data into a pandas dataframe

df = pd.read_csv('/content/china_gdp.csv')

df| Year | Value | |

|---|---|---|

| 0 | 1960 | 5.918412e+10 |

| 1 | 1961 | 4.955705e+10 |

| 2 | 1962 | 4.668518e+10 |

| 3 | 1963 | 5.009730e+10 |

| 4 | 1964 | 5.906225e+10 |

| 5 | 1965 | 6.970915e+10 |

| 6 | 1966 | 7.587943e+10 |

| 7 | 1967 | 7.205703e+10 |

| 8 | 1968 | 6.999350e+10 |

| 9 | 1969 | 7.871882e+10 |

| 10 | 1970 | 9.150621e+10 |

| 11 | 1971 | 9.856202e+10 |

| 12 | 1972 | 1.121598e+11 |

| 13 | 1973 | 1.367699e+11 |

| 14 | 1974 | 1.422547e+11 |

| 15 | 1975 | 1.611625e+11 |

| 16 | 1976 | 1.516277e+11 |

| 17 | 1977 | 1.723490e+11 |

| 18 | 1978 | 1.483821e+11 |

| 19 | 1979 | 1.768565e+11 |

| 20 | 1980 | 1.896500e+11 |

| 21 | 1981 | 1.943690e+11 |

| 22 | 1982 | 2.035496e+11 |

| 23 | 1983 | 2.289502e+11 |

| 24 | 1984 | 2.580821e+11 |

| 25 | 1985 | 3.074796e+11 |

| 26 | 1986 | 2.988058e+11 |

| 27 | 1987 | 2.713498e+11 |

| 28 | 1988 | 3.107222e+11 |

| 29 | 1989 | 3.459575e+11 |

| 30 | 1990 | 3.589732e+11 |

| 31 | 1991 | 3.814547e+11 |

| 32 | 1992 | 4.249341e+11 |

| 33 | 1993 | 4.428746e+11 |

| 34 | 1994 | 5.622611e+11 |

| 35 | 1995 | 7.320320e+11 |

| 36 | 1996 | 8.608441e+11 |

| 37 | 1997 | 9.581594e+11 |

| 38 | 1998 | 1.025277e+12 |

| 39 | 1999 | 1.089447e+12 |

| 40 | 2000 | 1.205261e+12 |

| 41 | 2001 | 1.332235e+12 |

| 42 | 2002 | 1.461906e+12 |

| 43 | 2003 | 1.649929e+12 |

| 44 | 2004 | 1.941746e+12 |

| 45 | 2005 | 2.268599e+12 |

| 46 | 2006 | 2.729784e+12 |

| 47 | 2007 | 3.523094e+12 |

| 48 | 2008 | 4.558431e+12 |

| 49 | 2009 | 5.059420e+12 |

| 50 | 2010 | 6.039659e+12 |

| 51 | 2011 | 7.492432e+12 |

| 52 | 2012 | 8.461623e+12 |

| 53 | 2013 | 9.490603e+12 |

| 54 | 2014 | 1.035483e+13 |

| 55 | 2015 | 1.105995e+13 |

| 56 | 2016 | 1.123700e+13 |

| 57 | 2017 | 1.232317e+13 |

| 58 | 2018 | 1.389188e+13 |

| 59 | 2019 | 1.436348e+13 |

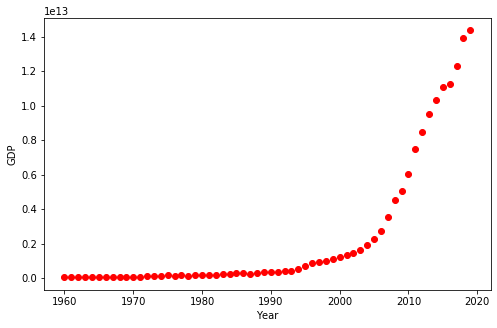

Plot the data

plt.figure(figsize=(8,5))

x_data, y_data = (df['Year'].values, df['Value'].values)

plt.plot(x_data, y_data, 'ro')

plt.ylabel('GDP')

plt.xlabel('Year')

plt.show()

We can see that the growth starts off slow. Then, from 2005 onwards, the growth is very significant. It decelerates slightly after the period of the 2008 global recession.

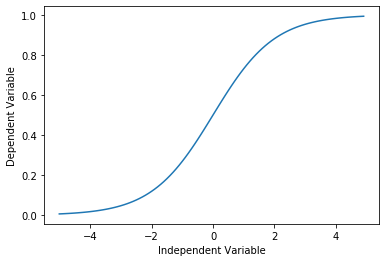

Choosing a model

Looking at the plot, a logistic function would be a good approximation, since it has the property of starting with a slow growth, increasing growth in the middle, and then decreasing again at the end.

Let’s check this assumption below:

X = np.arange(-5.0, 5.0, 0.1)

Y = 1.0 / (1.0 + np.exp(-X))

plt.plot(X, Y)

plt.ylabel('Dependent Variable')

plt.xlabel('Independent Variable')

plt.show()

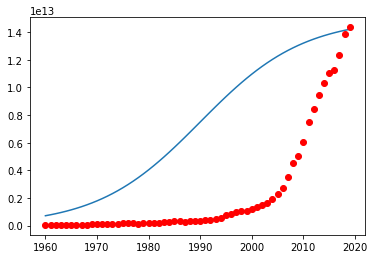

Build the model

Let’s build our regression model and initialize its parameters.

def sigmoid(x, Beta_1, Beta_2):

y = 1/ (1 + np.exp(-Beta_1 * (x - Beta_2)))

return yLet’s look at a sample sigmoid line that might fit with the data.

beta_1 = 0.1

beta_2 = 1990

# logistic function

Y_pred = sigmoid(x_data, beta_1, beta_2)

# plot initial prediction againts data points

plt.plot(x_data, Y_pred*15000000000000)

plt.plot(x_data, y_data, 'ro')[<matplotlib.lines.Line2D at 0x7f5c93a4d780>]

Our task is to find the best parameters for the model.

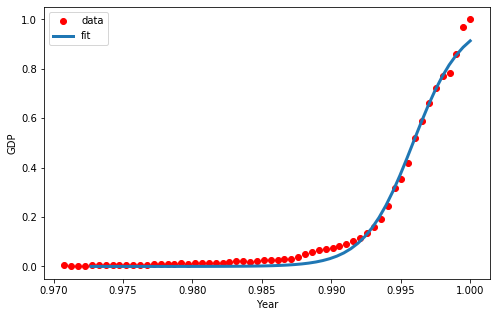

First, lets normalize our x and y.

xdata = x_data / max(x_data)

ydata = y_data / max(y_data)How can we find the best parameters for our fit line?

We can use curve_fit, which uses non-linear least squares to fit our sigmoid function to the data.

from scipy.optimize import curve_fit

popt, pcov = curve_fit(sigmoid, xdata, ydata)

# print the final parameters

print('beta_1=%f, beta_2=%f' % (popt[0], popt[1]))beta_1 = 571.415035, beta_2 = 0.995885Plot the model

# plot the resulting regression model

x = np.linspace(1960, 2015, 55)

x = x/max(x)

plt.figure(figsize=(8,5))

y = sigmoid(x, *popt)

plt.plot(xdata, ydata, 'ro', label='data')

plt.plot(x, y, linewidth=3.0, label='fit')

plt.legend(loc='best')

plt.ylabel('GDP')

plt.xlabel('Year')

plt.show()

Train/Test Split the data

Split data into training and testing sets.

msk = np.random.randn(len(df)) < 0.8

train_x = x_data[msk]

test_x = xdata[~msk]

train_y = y_data[msk]

test_y = ydata[~msk]Build the model using the train set.

popt, pcov = curve_fit(sigmoid, train_x, train_y)/usr/local/lib/python3.6/dist-packages/scipy/optimize/minpack.py:808: OptimizeWarning: Covariance of the parameters could not be estimated

category=OptimizeWarning)Predict GDP using the test set.

y_hat = sigmoid(test_x, *popt)Evaluate the model

print('Mean absolute error: %.2f' % np.mean(np.absolute(y_hat - test_y)))

print('Residual sum of error (MSE): %.2f' % np.mean((y_hat - test_y)**2))

from sklearn.metrics import r2_score

print('R2-score: %.2f' % r2_score(y_hat, test_y))Mean absolute error: 0.40

Residual sum of error (MSE): 0.17

R2-score: -34427.16